Topic 3: Handling Income Tax Notices From IT- Department

A notice from the Income Tax department brings about lots of stress. But it does not always have to mean bad tidings. Sometimes, it could be informing you about some tax refunds too!

The important thing to remember is to understand the reason for receiving the notice and replying to it timely and correctly! Also, the IT department is currently busy tightening its noose around the black money hoarders. Therefore, a lot of taxpayers are going to be receiving these notices soon.

How will you Receive the Notice from the Income Tax Department?

Verify the address associated with the PAN number by:

Income Tax Notices are Sent Under which sections

Five different types of Notices are send under different sections of the I-T Act of 1961.

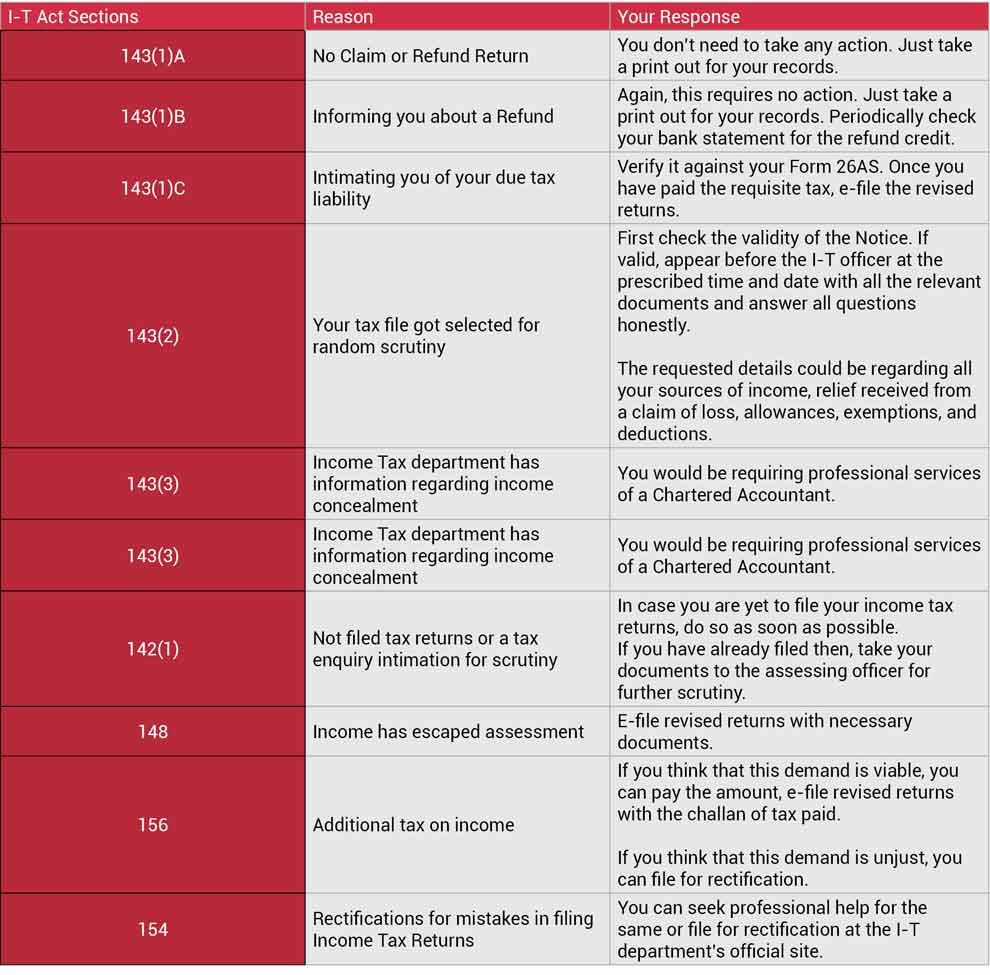

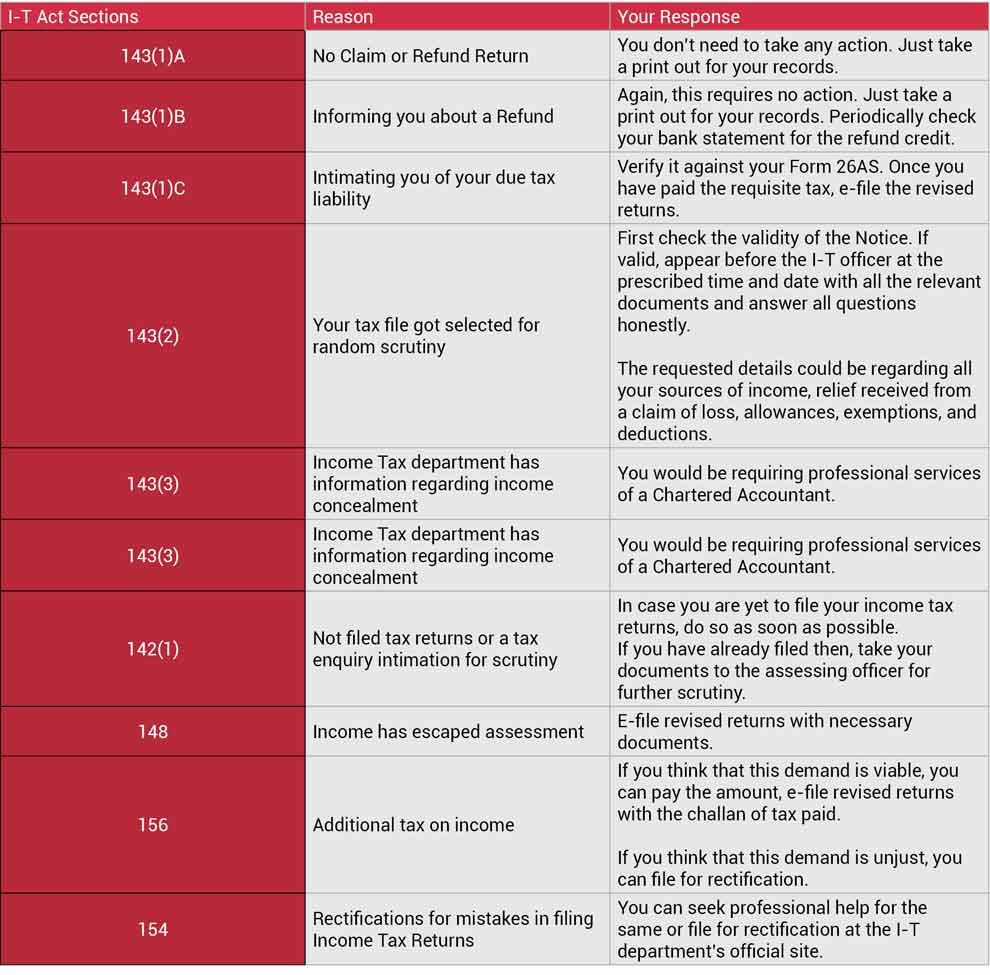

What Response should you Give When You Receive an Intimation from the I-T Department

Let us present your reply to the Notices from the Income Tax department in a tabular form:

Source: policybazaar.com

The important thing to remember is to understand the reason for receiving the notice and replying to it timely and correctly! Also, the IT department is currently busy tightening its noose around the black money hoarders. Therefore, a lot of taxpayers are going to be receiving these notices soon.

How will you Receive the Notice from the Income Tax Department?

- The intimation from the I-T department would be sent on the email id provided during the e-filing of Income Tax Returns.

- If CPC is processing the returns, the sender’s email id would be: intimations@cpc.gov[dot]in.

- The Notice would arrive by Post to the address as per PAN details.

- Visiting the e-filing ITR site

- Logging in with your PAN number as the User ID and a secure password

- Filling in your date of birth details and verifying the captcha

- Under ‘Profile Settings’ you can then opt for the ‘PAN details’ from the dropdown menu and confirm

Income Tax Notices are Sent Under which sections

Five different types of Notices are send under different sections of the I-T Act of 1961.

What Response should you Give When You Receive an Intimation from the I-T Department

Let us present your reply to the Notices from the Income Tax department in a tabular form:

Source: policybazaar.com